AP Macro Unit Cheat Sheets

Key terms, formulas, and graphs for every unit.

Strengthen your mastery of Unit 4!

Test your knowledge with a full-length practice test.

Dojo Drills

4.1 - Financial Assets

Videos

Key Terms & Definitions

Financial Asset

Something that holds financial value, such as stocks, bonds, gold, or real estate.

Bond

An investment that pays interest over time. Buying a government or corporate bond is essentially lending money to that entity.

Stock

A financial asset that represents a share of ownership in a company.

Certificate of Deposit (CD)

An interest-bearing savings account that holds a fixed amount of money for a fixed period, such as six months or a year. Part of the M2 money supply.

Liquidity

How easily an asset can be converted into cash without much loss of value.

- •Cash is the most liquid asset; a house is the least liquid.

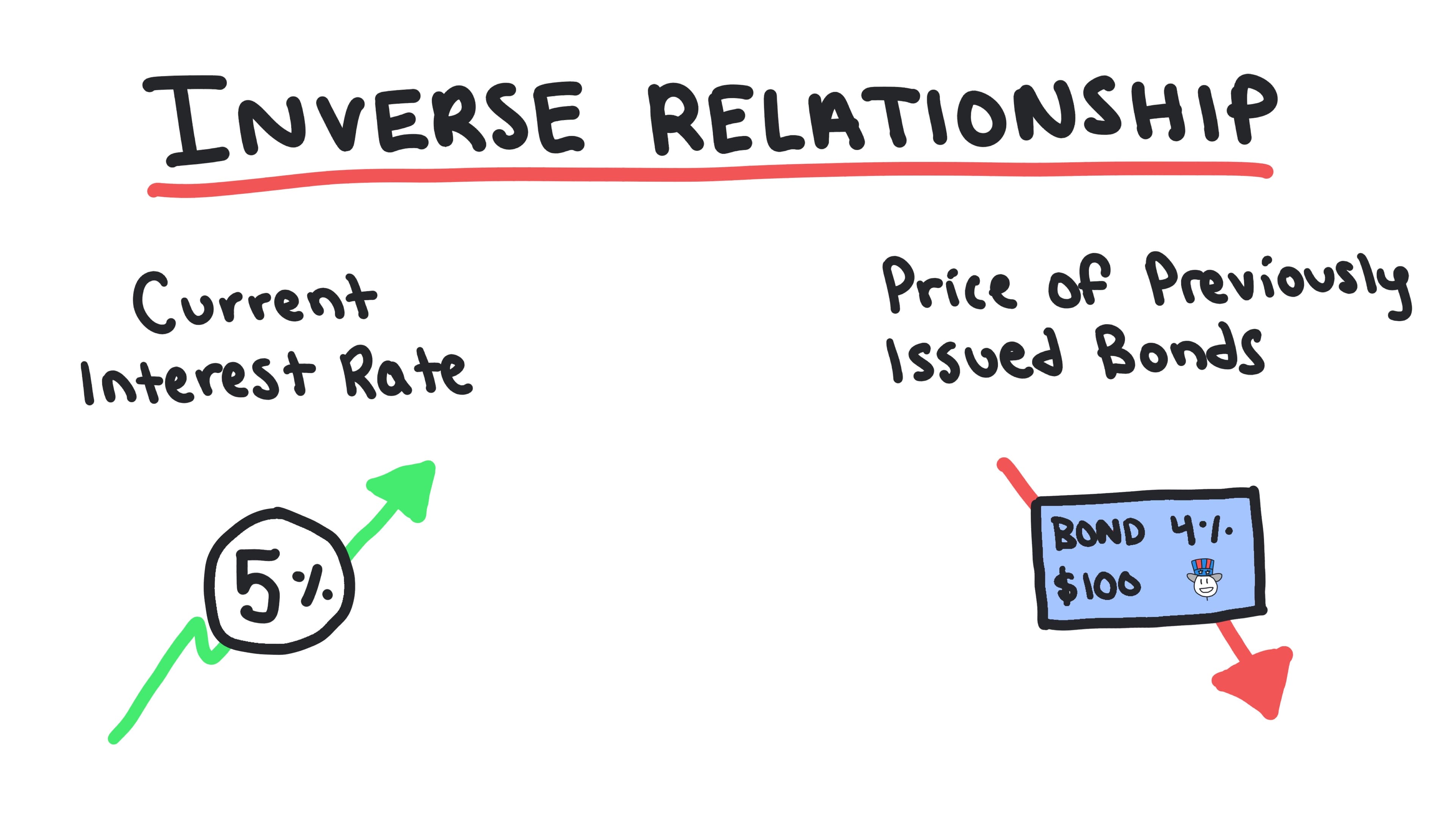

Inverse Relationship between Interest Rates and Bond Prices

When current interest rates go up, the price of previously issued bonds with lower interest rates goes down.

- •Example: If new $100 bonds pay 5% interest, an old $100 bond paying 3% must be sold for less than $100 to compete.

Whiteboards

4.2 - Nominal v. Real Interest Rates

Videos

Key Terms & Definitions

Interest

The cost of borrowing money.

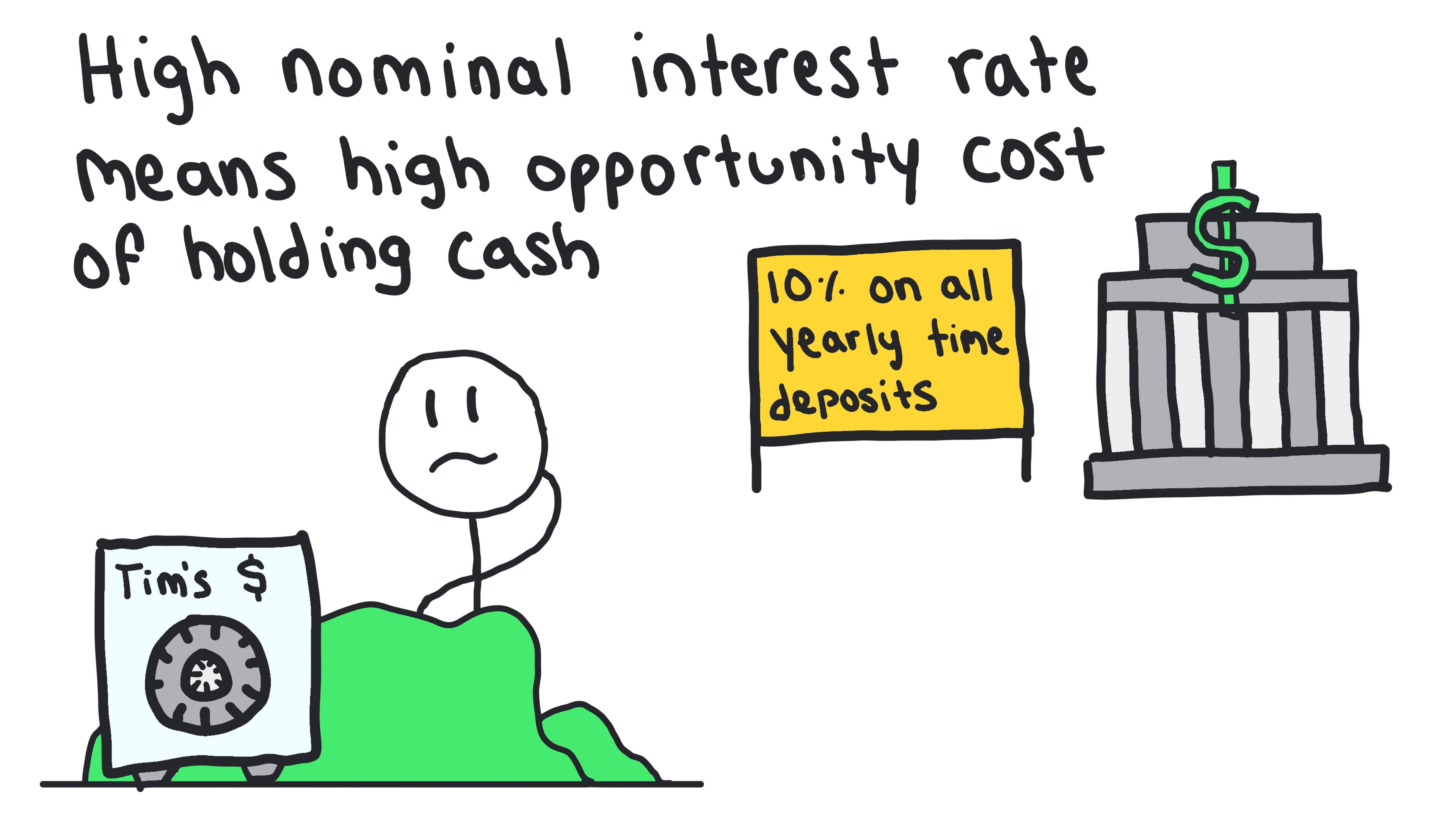

Nominal Interest Rate

The interest rate stated on a loan, as a percentage of the amount borrowed.

Real Interest Rate

The nominal interest rate adjusted for inflation, showing the true gain in purchasing power for a lender.

- •Formula: Real Interest Rate = Nominal Interest Rate - Inflation Rate

Expected vs. Actual Inflation

Differences between expected and actual inflation create winners and losers.

- •If actual inflation is lower than expected, lenders win and borrowers lose.

- •If actual inflation is higher than expected, borrowers win and lenders lose.

Whiteboards

4.3 - Definition, Measurement, and Functions of Money

Videos

Key Terms & Definitions

The Three Functions of Money

To be considered money, something must serve as a medium of exchange, store of value, and unit of account.

- •Money must fulfill all three functions: Medium of Exchange, Store of Value, and Unit of Account

Medium of Exchange

A function of money where it is used to buy goods and services, avoiding the need for barter.

- •Example: Instead of trading 5 chickens for a pair of shoes (barter), you can use money (dollars) to buy the shoes directly. This makes transactions much easier and more efficient.

Store of Value

A function of money where it holds wealth over time without expiring or losing its value.

- •Example: You can save $100 today and use it to buy goods and services in the future. Unlike perishable goods like food, money doesn't spoil or expire, allowing you to preserve your purchasing power over time.

Unit of Account

A function of money where it serves as a standard measure for pricing goods and services.

- •Example: Prices are expressed in dollars (e.g., a pizza costs $12, a movie ticket costs $15). This allows easy comparison of values - you can quickly see that the movie ticket is more expensive than the pizza, without needing to know how many pizzas equal one movie ticket.

Money Supply

The total amount of money circulating in an economy, measured in categories based on liquidity.

- •M1: Most liquid assets (cash and checking deposits).

- •M2: M1 plus savings accounts, money market accounts, and CDs.

- •Bonds are not part of the money supply.

Monetary Base

All physical currency in circulation plus the reserves banks hold.

Whiteboards

4.4 - Banking and the Expansion of the Money Supply

Videos

Key Terms & Definitions

Demand Deposit

Money deposited in a bank account that can be withdrawn on demand.

Asset (Banking)

Something a bank is owed or owns; money that will come to the bank.

- •Examples: Loans made to customers (the bank is owed repayment), reserves held at the bank, securities owned by the bank

Liability (Banking)

Something a bank owes to others; money the bank must pay out.

- •Examples: Customer deposits (the bank owes customers their money back when they withdraw), money the bank has borrowed

Required Reserve Ratio (RRR)

The fraction of deposits banks are required to keep in reserve.

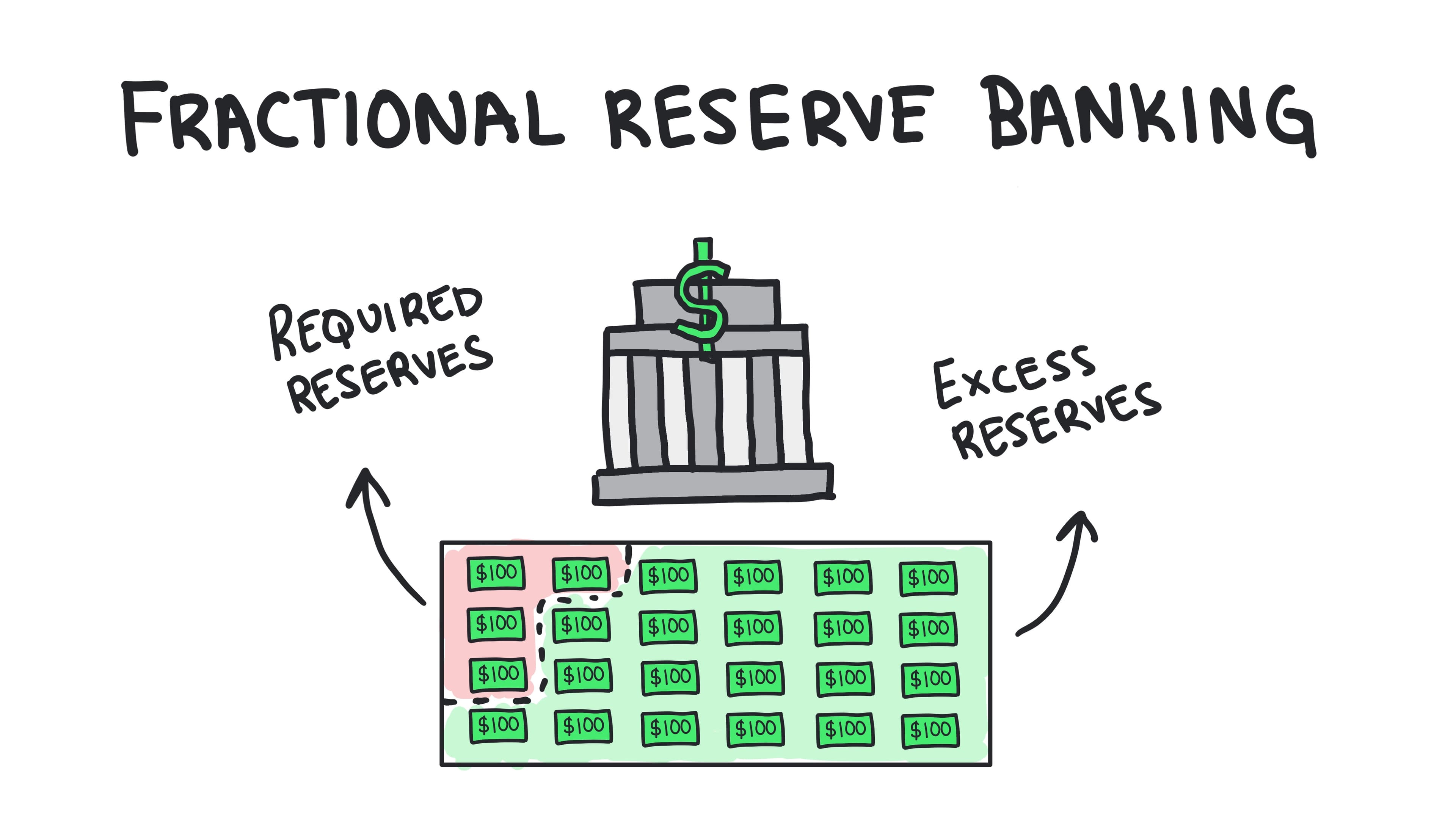

Required Reserves

The dollar amount of deposits a bank must hold and cannot lend out.

Excess Reserves

Reserves held by a bank beyond the required amount; can be lent out.

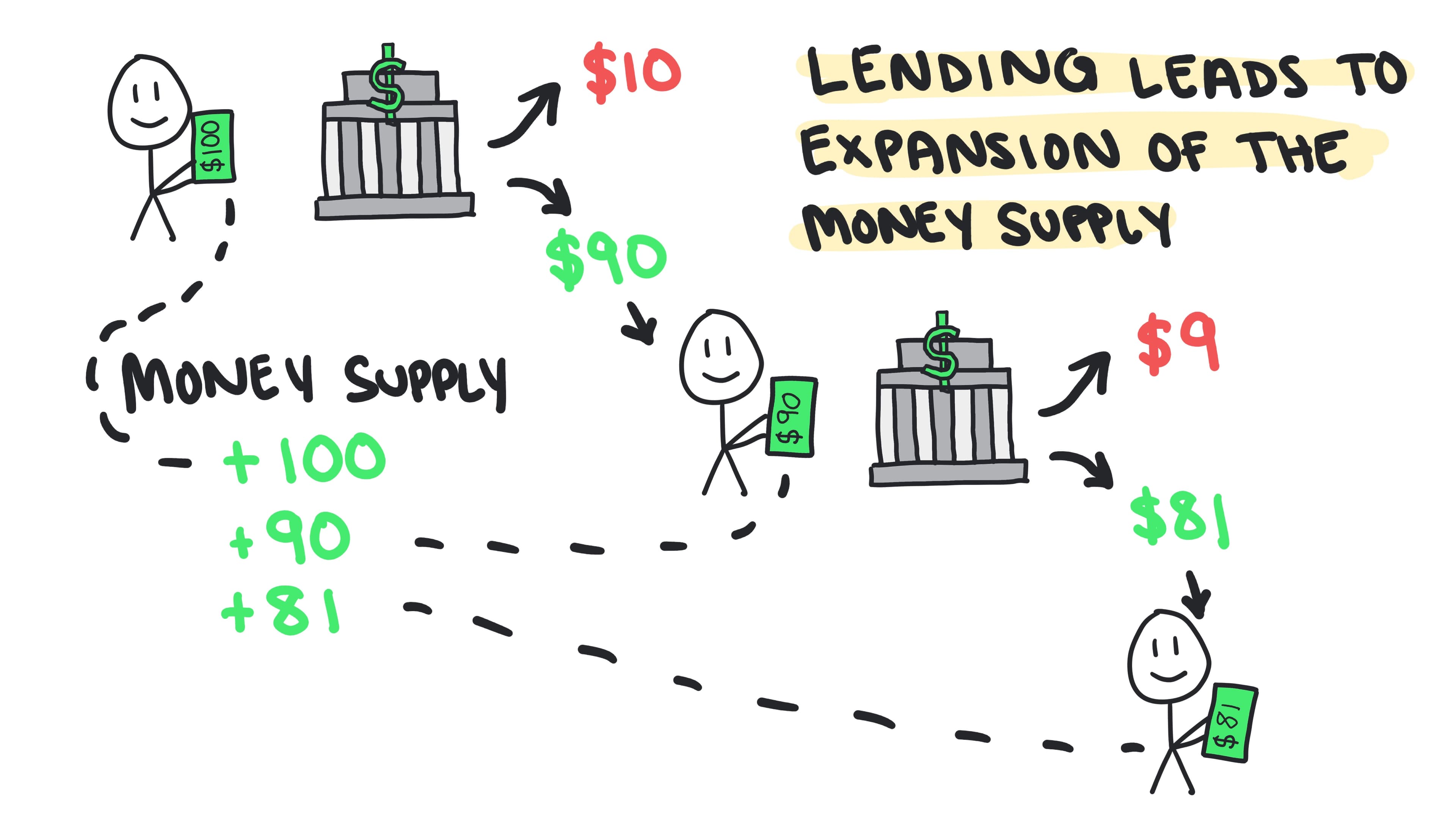

Fractional Reserve Banking System

A banking system where banks keep only a fraction of deposits in reserve and lend out the rest.

Money Multiplier

Shows the maximum potential expansion of the money supply from an initial deposit.

- •Formula: Money Multiplier = 1 / Required Reserve Ratio

Maximum Potential Expansion of the Money Supply

The total possible increase in the money supply from an initial deposit.

- •Formula: Maximum Expansion = Initial Excess Reserves x Money Multiplier

Whiteboards

Checkpoint

Test your understanding of 4.1

Financial assets represent:

Checkpoint

Test your understanding of 4.2

The real interest rate equals:

4.5 - The Money Market

Videos

Key Terms & Definitions

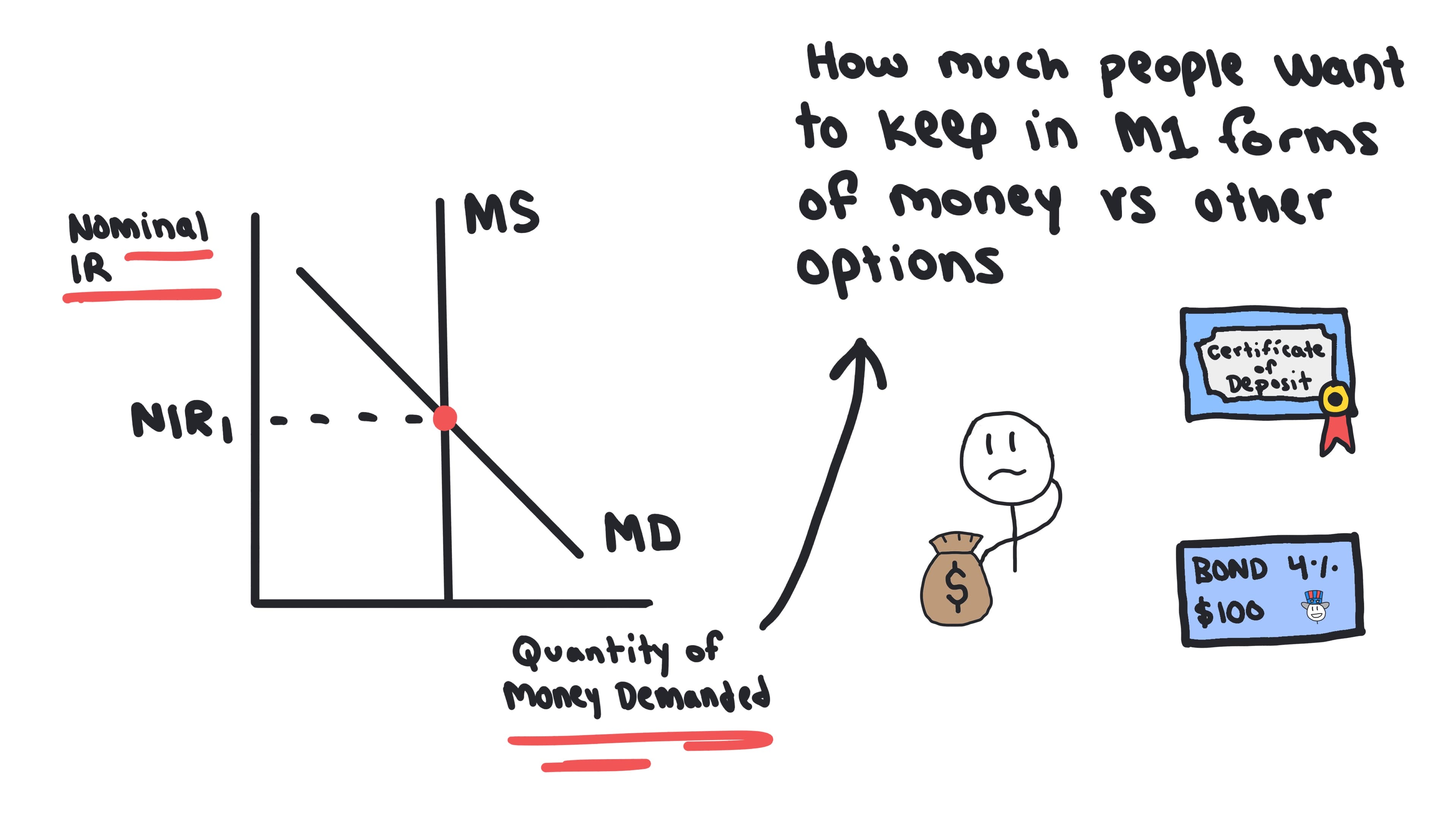

Money Market

Graph showing the relationship between the supply of money and the demand for money, determining the equilibrium nominal interest rate.

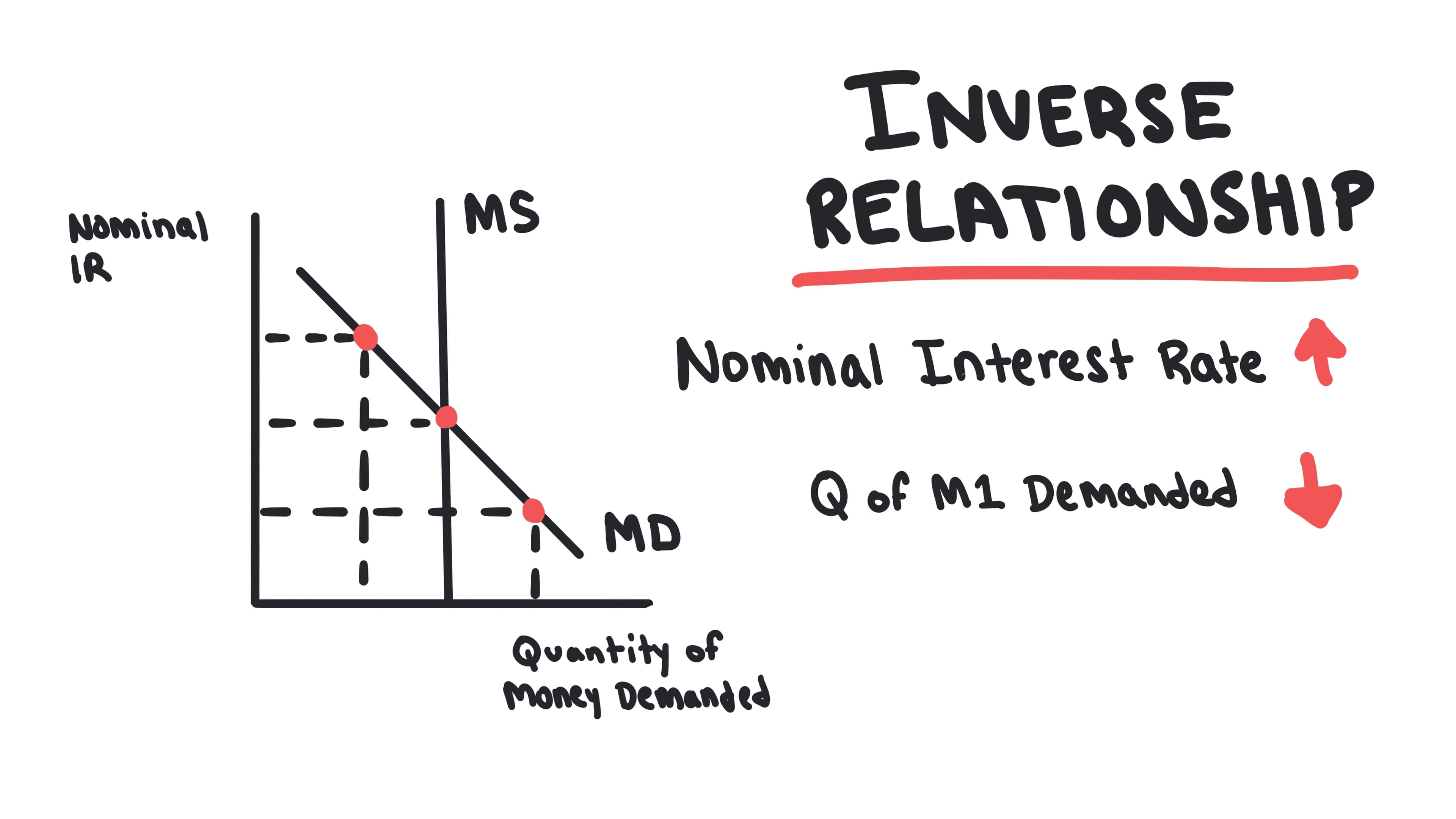

Money Demand

Shows the inverse relationship between the nominal interest rate and the quantity of money people want to hold in M1 forms.

- •Shifters: Changes in price level and changes in real GDP/income.

Money Supply (in the Money Market)

A fixed quantity of money at a given time; shown as a vertical line in the money market.

Equilibrium Nominal Interest Rate

The nominal interest rate where money supply and money demand intersect.

Whiteboards

4.6 - Monetary Policy

Videos

Key Terms & Definitions

Central Bank

A country’s “bank for banks.” In the U.S., this is the Federal Reserve, which conducts monetary policy.

Commercial Bank

A bank where individuals and businesses can deposit money, such as Citibank. Can borrow from the central bank.

Monetary Policy

Actions taken by the central bank to manage the money supply and influence economic outcomes.

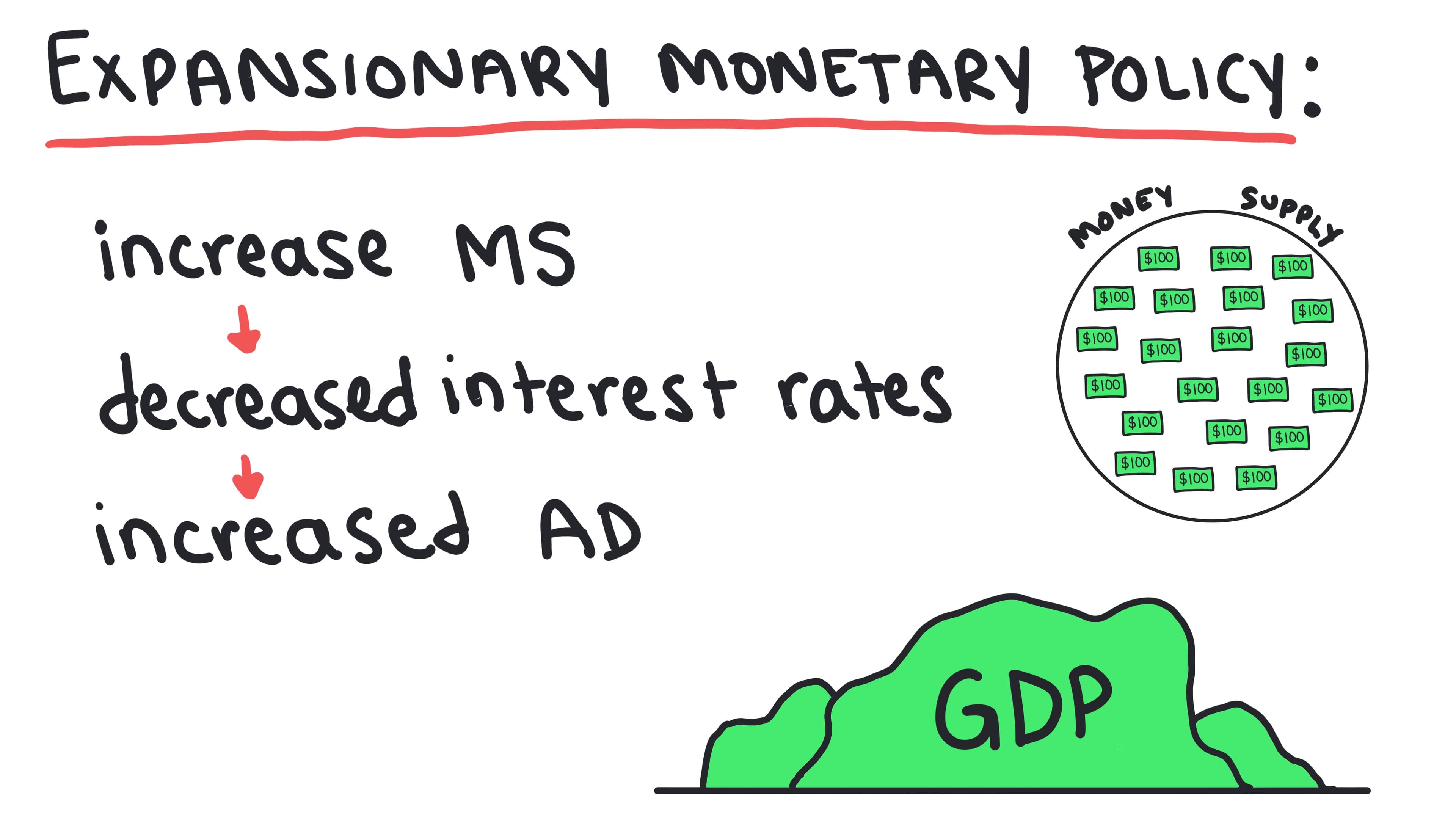

Expansionary Monetary Policy

Increases the money supply to lower interest rates, encouraging consumption and investment during a recessionary gap.

Contractionary Monetary Policy

Decreases the money supply to raise interest rates, reducing consumption and investment during an inflationary gap.

Tools of Monetary Policy

The main ways a central bank changes the money supply: Required Reserve Ratio, Discount Rate, and Open Market Operations.

- •Lower RRR → expands money supply; raise RRR → contracts it.

- •Lower discount rate → expands; raise discount rate → contracts.

- •OMO: Buy bonds → expands; Sell bonds → contracts.

Monetary Policy and the AD-AS Model

Monetary policy affects AD through changes in the money supply, interest rates, and investment/consumption.

- •Change in money supply → change in nominal interest rate → change in investment & consumption → shift in AD curve → change in Real GDP and Price Level.

Whiteboards

4.7 - The Loanable Funds Market

Key Terms & Definitions

Loanable Funds Market

Market showing the interaction of borrowers (demand) and savers (supply), determining the equilibrium real interest rate.

Demand for Loanable Funds

Comes from borrowers; downward-sloping because lower real interest rates make borrowing cheaper.

- •Shifters: Government deficit spending, borrower expectations.

Supply of Loanable Funds

Comes from savers; upward-sloping because higher real interest rates make saving more rewarding.

- •Shifters: Savings rate, capital inflow.

Equilibrium Real Interest Rate

The real interest rate where the supply and demand for loanable funds are equal.

Whiteboards

Checkpoint

Test your understanding of 4.5

In the money market, the demand for money is:

Checkpoint

Test your understanding of 4.6

Expansionary monetary policy involves: